Investment Thesis

As China’s Water Pollution Action took full effect at the end of 2017 following the nation's mandating of wastewater reuse and treatment policies in all of its roughly 3,500 industrial complexes, companies like Newater Technology (NASDAQ:NEWA) are set to enjoy a continued boost to revenues.

As a result of the company's core wastewater treatment offerings of disk tube reverse osmosis and disk tube nanofiltration, which are seen as more effective in several industry sectors than the solutions currently implemented, revenues have grown from around $1 million in 2014 to over $12 million in 2016 as a result of a higher share in the Chinese industrial and commercial wastewater market.

As this explosive growth takes place and as new contracts and partnerships emerge, share price has done very little whilst revenue and estimates for Newater and the industry as a whole continue on an uptrend, expecting a 70% and 13.8% growth rate, respectively. I believe the market has not yet priced in the full effect of this technology fully penetrating into an already high growth market and an investment in this company will yield high return to shareholders.

Market Overview

In 2012, with the Chinese government taking a renewed look at environmental control options following its robust economic growth in the preceding years, several spending shifts occurred aimed to become law in the following years. In 2015, after the appointment of a new environment minister in China, the water pollution action was released to be implemented through 2017. With around 85% of river and underground water being polluted from industrial complexes, they put forth a program to force companies to reuse and treat wastewater being sent into rivers and ground streams.

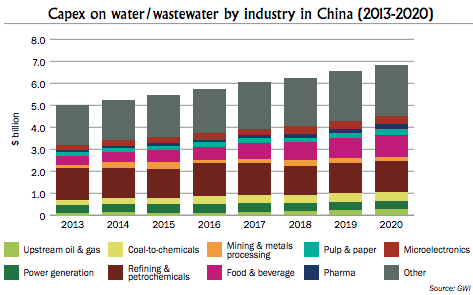

As the overall wastewater treatment market in China is expected to reach $6.8 billion in spending through 2020, key markets like Refining & Petroleum is expected to grow at a 13.7% CAGR, Coal-to-Chemical at a 9% CAGR and Industrial Wastewater is expected to grow at an overall pace of 5.7% annually accounting for the majority of the aforementioned $6.8 billion in spending.

(Source: Global Water Intelligence Report)

This high growth rate through 2020 is expected to be boosted further by recent commitments by the Chinese government for both commercial and agricultural wastewater cleanup, treatment and management, favoring companies like Newater with their commercial technologies and services.

Business Overview

Newater Technology offers wastewater treatment solutions through DTRO and DTNF, while the currently used solutions include Oxidation Ditches, Anaerobic Anoxic OXic process and Sequencing Batch Reactors for wastewater treatment which are being used by the majority of Chinese treatment plants. As for industries like power and cooling, wastewater treatments are being met most efficiently with a combination of reverse-osmosis and electro-dialysis reversal, Newater's solutions have the opportunity to grow faster than peers.

Furthermore, the paper and pulp market is showing significant progress with new developments in the nanofiltration systems, which are slightly more efficient than the biological anaerobic solutions, creating a better growth environment for the company's nanofiltration offerings.

As these existing solutions already have a high market penetration and use in China, Newater has the opportunity to introduce their technologies to industrial complexes around the country as non-chemical based solutions grow at a rapid pace of around 50% annually, according to Bharat Book Bureau research report on the Chinese wastewater treatment market.

China's WWT technologies are in a nascent stage; ~60% of the domestic municipal WWTPs use Oxidation Ditch Process (OD), Anaerobic-Anoxic-Oxen (A2/O), and Sequencing Batch Reactor (SBR). However, Membrane Biological Reactor (MBR) is the fastest-growing WWT process in China, with over 50% year-on-year growth over the past five years, although its current market share in domestic WWTPs is still very small.

Organic Growth: Market Share

As Chemical solutions were preferable through 2015, growing at the fastest pace, the non-chemical solutions are expected to grow at the fastest pace through 2020, at an over 20% annual rate, driven primarily by a renewed regulatory emphasis and a shift in market share. As a result, Newater's core offerings of membranes and filtration systems are set to rapidly outpace industry wide growth as they capture market share, growing contracts and orders from Chinese industrial complexes.

As annual sales point to an overall market share of 0.02%, 0.16% and 0.28% for 2014, 2015 and 2016, respectively, this uptrend is expected to continue as their overall sales growth exceeds industry wide expected CAGR of 13.8%.

The company's solutions form around 7% of current market share globally, according to a Frost & Sullivan 2016 Global Water Market report, which may be slightly underestimating the Chinese market in 2017 as non-chemical solutions become more widely adapted, meaning the company has the ability to grow into a $476 million market (author estimate: 7% of the $4.5 billion market in 2016) with their effective solutions, with current revenues implying a 2.6% market share in the membrane market.

As chemical solutions remain the majority of treatment uses in the country, the higher non-chemical growth rate, which continues to grow at a 50% annual rate, will continue to grow its market share as more industrial complexes opt to comply with regulatory demands.

Inorganic Growth: Blockchain

Newater Technology recently partnered with NW Blockchain to bring blockchain solutions to the wastewater and agricultural technologies world, which initially caused prices to spike significantly only to return to previous levels. I believe this price action is insignificant in the long run given the hype around blockchain technology and tokens which in recent weeks has been proven to be short lived and any price appreciation in the future would have to be tied to actual sales increases.

Under the terms of the partnership, NWBL will purchase equipment needed to produce tokens from Newater and then Newater will receive 20% of net proceedings of sales, which I believe can become a significant revenue stream in the next few years.

As no major Chinese companies use blockchain technology in their wastewater treatment offerings thus far, I believe this presents a slight advantage when an industrial complex searches for wastewater management given the effectiveness and security-related peace of mind that comes with the connected system of blockchain technologies. We will, I believe, get more information on how this effects future orders and contract wins in H2 of 2018 when they report their financial results.

Investment Risks

The main risk associated with water and wastewater is the lower industrial consumption and output rate and higher overall pricing of water causing a further decline in its use. Given less water gets used in a plant remains a hindrance to industry growth in the long run as less business is available for a growing number of companies. It is yet to be seen if these factors will have any effect in market projections in the coming years but I believe that in the case of Newater, still capturing existing market share with their effective solutions, will remain fairly immune for the next several years until their market share environment is saturated.

Another risk is the amount of companies in China producing membrane technologies, like Chuneng Industrial Filtration (PRIVATE), which supplies membrane technologies to a variety of industrial needs around the country and other smaller companies entering the market place. I believe, however, that Newater will be able to maintain its competitive advantage given their deployed infrastructure and sales teams and have the marketing skills to continue driving their own market share even if it's spread thin.

Other risk factors include a lack of historical operations context to accurately predict certain financial outcomes, which may hurt valuations, and the fact that the company relies on a limited number of vendors and a concentrated revenue source which can materially affect their continued revenue streams if a vendor or client decides to terminate their contracts. Some localized risks include wage increases which can hurt the company's margins and pressure on management as they continue to rapidly expand, creating potential inconsistencies in their operating environment and in turn hurt their business.

Valuation

The company’s sales growth remains impressive growing from $1.03 million in 2014 to $6.95 million in 2015 and $12.28 million in 2016 with H1 of 2017 coming in at $7.2 million, a growth rate of over 50% from H1 2016.

Looking at the company’s balance sheet, it’s encouraging that the company utilizes short term loans but holds no long term debt and has minimal interest expense annually. They hold $1.58 million in cash as they remain cash flow positive since their IPO. Newater’s assets far exceed their liabilities with $3.4 million in equipment and land and $10.4 million in inventories, most of which are completed products with some raw materials.

As projects become more complex, Newater had to hire additional engineers and spend more capital to set up operations in industrial complexes which caused their profit margin to slump to the lower end of the spectrum, falling from over 40% to 26.67% in the latest quarter.

I believe this was a significant part of the lack of price appreciation as sales growth and partnerships continue to point to a bullish future but believe current sentiment is misguided as these engineers the company has hired remain part of the workforce and higher capital spent in locations in which the company is expanding remain in place and available for future deployments and contracts, creating short term woes but long term tailwinds.

As sales continue their high growth trajectory, the company is trading at around 10x fiscal 2016 sales. As no analysts cover the stock and management does not provide any short or long term guidance, the leading indicator for the company's growth is industry-wide projections alongside historical growth. As a result, I believe the company can comfortably continue to gain market share in the $476 million membrane sector and in the $4.5 billion overall industry.

In the past, the company has reported H1 sales to be roughly 10% to 30% of full year sales ($0.58M of $6.98M in 2015 and $4.78M of $12.28M in 2016) meaning its H1 2017 sales of $7.2 million project full year 2017 sales of around $21 million, a 70% Y/Y growth, which I believe is conservative.

As the company still has quite a lot of room to grow, I believe a continued 10x multiple is warranted giving the company a $210 million valuation based on expected 2017 revenues, or $19.80 per share based on 10.6M shares outstanding.

Investment Conclusion

For investors looking to tap in to the high environmental spending market currently taking place in China, Newater Technology enjoys several short and long term prospects:

The Water Pollution Action, mandating all industrial complexes to outsource wastewater treatment to 3rd party companies is helping to boost overall market growth to low double digit growth.

The mandate being enforced with a H2 2017 deadline will likely boost the company’s contracts and orders in the second half of 2017 and provide for a significant upside in revenues and share price.

As the company continues to capture market share with their DTRO and DTNF treatment technologies and support services, sales growth is expected to continue and outpace industry averages and peers, amounting to higher valuations and a steady price appreciation through the upcoming years.

Thank you for reading this Seeking Alpha PRO article. PRO members received early access to this article and get exclusive access to Seeking Alpha's best ideas. Sign up or learn more about PRO here.

Disclosure: I am/we are long NEWA.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

http://ift.tt/2GnD5sI

0 Response to "Newater Technology: Capitalize On China's Industrial Wastewater Investments And Regulations - Seeking Alpha"

Post a Comment