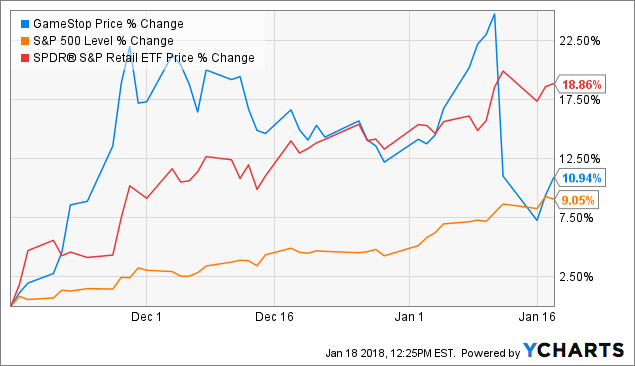

GameStop (GME) was in rally mode at the end of 2017. Alongside the rest of the market, GME stock was moving higher on budding tax reform optimism. Alongside peer retail stocks, GME stock was moving higher on chatter that consumers opened their wallets more than usual during holiday 2017. Those two tailwinds combined to make GME stock a big winner in November and December.

But then GameStop announced holiday numbers, and while they were largely strong across the board, the company's once shining star Technology Brands business produced nothing but coal during the holiday season. Investors reasonably freaked out that this supposed savior of GameStop's business was nothing more than a head-fake, and GME stock sold off sharply.

While we believe those concerns have merit, we also feel that GameStop's strong holiday numbers underscore that the company's business model has longevity thanks to recurring innovation in product hardware and software in the video game business. Consequently, we believe the current valuation is depressed. We think the recent sell-off offers an attractive "buy the dip" opportunity.

GME data by YCharts

GME data by YCharts

First, let's address the elephant in the room. When GameStop's business model started drawing comparisons to Blockbuster, management reasonably felt it was necessary to diversify revenue streams. And so the Technology Brands business was born, a way for the company to grow revenues by selling something not related to video games (in this case, phones).

Management sold investors on the dream that this was going to be the savior of GameStop's crumbling business. And the numbers supported the talk. Last year, Technology Brand's revenue was rising in the 40%/50%/60% range.

But that growth story has come off the rails. Not only did Technology Brands revenue fall 10% last quarter, but it fell nearly 20% during the all-important holiday period. Management is citing limited availability of the iPhone X and changes made by AT&T (NYSE:T) to the compensation structure in 2017 as reasons for the revenue decline.

Regardless, the writing is on the wall. This is NOT a hyper-growth segment. But it's also NOT a dead business. It pays to remember that declines this year are lapping big growth numbers last year, and that growth on a 2-year basis is still hugely positive. Into perpetuity, consumers will always buy phones, so this business doesn't really look at risk from a longevity standpoint. Consequently, this business isn't dead. It just won't produce the out-sized returns that management and investors had hoped for.

Second, it is important to note that improving results at the company's video game business mean that GameStop doesn't need a burgeoning Technology Brands business to support its anemic valuation.

The holiday numbers in the video game business were really good, driven by new product launches. Holiday comps rose nearly 12%. They were trending up in the low single-digit range before that. Total global sales rose almost 11%, versus a 3% rise through the first 9 months of 2017. Omni-channel sales jumped 21.5% higher. Hardware sales roared 38% higher thanks to the Xbox One X and Nintendo Switch. Collectibles sales rose about 20%. New video game sales rose 7%.

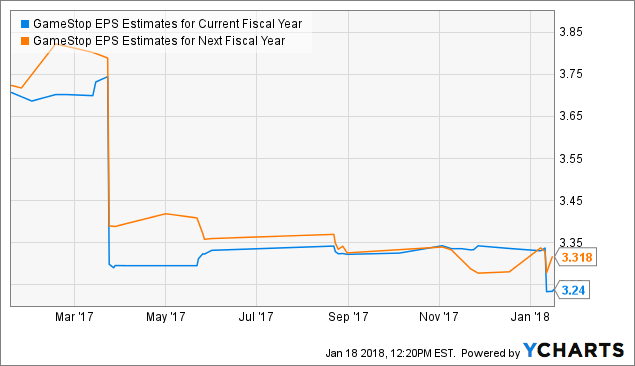

The used video game business continued its secular decline, but strength from new products offset that weakness and management maintained its full-year earnings guide of roughly $3.25 per share. Overall, then, despite the used game business continuing to decline and the company's hyper-growth Technology Brands business going belly-up, net earnings level remained consistent with the guide.

Why? Improvements everywhere else. Concerns that these improvements are short-lived seem short-sighted. Granted, this year is especially good in terms of product innovation in the video game space, but this innovation won't stop. New consoles come out all the time. These new consoles can't be purchased online. They will forever have to be purchased in-store.

Therefore, with each new console launch, a ton of customers will head into GameStop to get the new console. Those customers will likely buy a few new games to go alongside the console, burgeoning new video game sales, and maybe some collectibles too, burgeoning the collectibles business.

All in all, GameStop's business has longevity so long as product hardware innovation persists in the video game business. Considering we are entering the era of augmented and virtual reality, this product hardware innovation should do more than persist. It should accelerate, meaning GameStop's business will do just fine in the foreseeable future.

This is likely why earnings estimates for next year are higher than earnings estimates for this year.

GME EPS Estimates for Current Fiscal Year data by YCharts

GME EPS Estimates for Current Fiscal Year data by YCharts

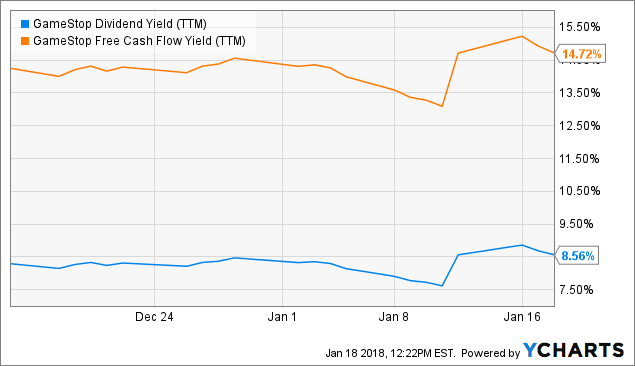

And yet despite that stabilized earnings base, GME stock still trades at just 5x trailing earnings with a 15% free cash flow yield and 9% dividend yield.

GME PE Ratio (TTM) data by YCharts

GME PE Ratio (TTM) data by YCharts GME Dividend Yield (TTM) data by YCharts

GME Dividend Yield (TTM) data by YCharts

Bottom line: GameStop doesn't need a super-charged Technology Brands business to support its anemic valuation because operational improvements in the video game business are causing earnings stabilization even with declining Technology Brands sales. That makes GME stock a buy at these deeply discounted levels.

Disclosure: I am/we are long GME.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

http://ift.tt/2mXPlrS

0 Response to "Technology Brands May Be A Failure, But GameStop Isn't ... - Seeking Alpha"

Post a Comment