Introduction

I am the original Deepwater bull. Some say Deepwater nut, but fewer and fewer as time goes by. I don't think it's going to come back strongly, I know it will. It must because the big operators need new giant discoveries to take the place of older ones, that have been on production for a few years now. Nothing lasts forever, and while they produce for much longer than shale wells, as we have discussed in previous articles, they will eventually play out. I've made the case for this in a number of articles over the past few months that I've been writing for SA.

That day is not that far off. But, I don't want to run around that tree too extensively in this article. We're here to see another aspect of the company

I originally brought Carbo Ceramics, (CRR) to your attention as part of an effort to start building the contrarian case for companies that thrive on Deepwater development. I say contrarian, because we are still not at the big inflection point where companies are reallocating capital to the Deepwater mega-projects we will all be depending on to fill our gas tanks in a few years. That being the case, investing in a company primarily poised to thrive on revenues from Deepwater operations, is a contrarian play. Those are the ones that will make the most money when...wait, there I go again talking about Deepwater. I am like a moth to the flame on this topic.

On to Frack Class.

The Frack Rationale

Fracking opens up channels in tight rock to allow for the easy flow of oil and gas into the well bore. In some formations, Tight sands, shale, carbonates chief among them, no frack, no flow. That's it. Finito. Over and done.

Once you accept that to produce an interval for more than just a day or two, you will have to inject millions of pounds of proppant into cracks, or fractures hydraulically created in the rock, the question then becomes..how will you do this most efficiently? That is to say, put most of the proppant where most of the oil is. You got to know the territory!

Source Screen capture from the Music Man. If you are of a certain age you will remember this classic.

And, there-in lies the rub. If you don't really understand your rock properties (areas of greatest porosity and permeability, as well as the mechanical properties of the rock-Young's modulus, and Poisson's ratio) and stresses caused by the over-burden, not to mention the petrophysics of the rock's individual grain structure...you may not get what you are planning for from the well.

That is where a company like Carbo Ceramics can make a difference.

Reservoir modeling

Computer modeling has become the cornerstone of engineering in the modern world. In every discipline you can think of the brains of engineers, physicists, chemists have been leveraged digitally to distribute this knowledge across a wide array of engineering backgrounds. We call this software, or more commonly these days, Artificial Intelligence-AI.

Enter FRACPRO.

FRACPRO is a component of suite of software simulation models marketed by Carbo. We are going to focus on FRACPRO in this article, just be aware that it's not the only tool in the kit.

Let's start by thinking of the calculations we have to run before commencing a frac.

- How much pressure on location will I need to overcome pipe friction, and the down hole pressure to initiate the fracture?

- What does that correlate to in terms of hydraulic horsepower requirements?

- What will the dimensions of the fracture opening be?

- Is that enough to flow the well economically?

- In what direction in relation to the proposed well bore will the fracture grow?

- What depth of penetration can I expect?

- Is there anything I can do to optimize that depth?

- What is the optimal sand/proppant loading for each stage of the treatment?

- Can I rely on velocity to transport the proppant efficiently, or should I design a gel-frac?

- What rate should I pump the frac? (This is related to the question above)

- If I change one parameter, what are the effects on other parameters?

- How much crushing can I expect while placing the frac?

- What will the proppant embedment be with the with the Young's modulus of the reservoir rock?

- What will the reduction in permeability be as a result?

- Etc.

I could go on, but these questions form the low-hanging fruit of fracking.

To answer them we can either get out our Rockwell 9TR 4-function calculator, that we've kept in pristine condition for the last 45 or so years, OR...

Source (Anyone remember the Rockwell jingle? First one to comment with the correct jingle gets a DDR coffee mug. No fair Googling it!)

...we can use a modern tool like FRACPRO and complete the task before the universe expands to it's farthest reach and then begins to collapse upon itself. Who wants to be stuck out on an oil rig punching buttons on a 4-function calculator when the universe collapses, I ask you!

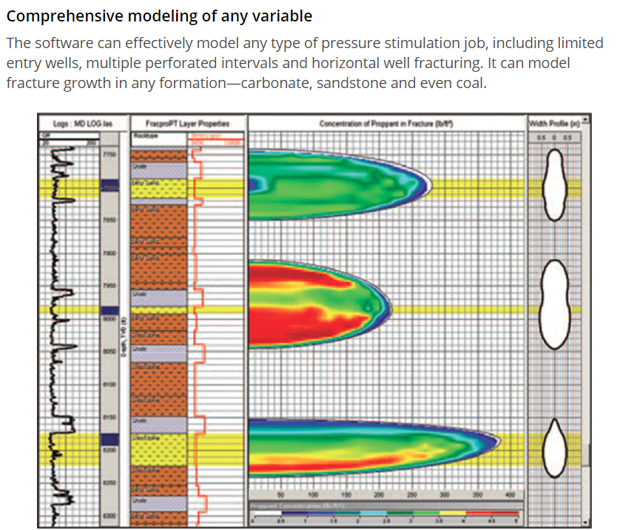

In this graphic we see the modeled result of the injectivity of three sand packages, and the resultant frac lengths. A representation that takes into account all of the questions we posed above. It took probably a couple of hours to set up the model, and maybe a minute or two for it to run. Task done, well before the end of the universe!

Ok now let's go to the rig

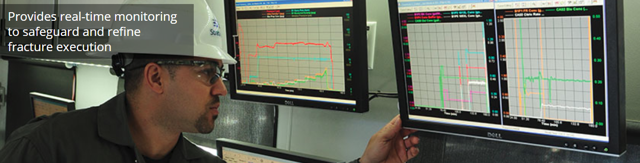

You might think that with all the work bulleted above accomplished, that we are now ready to just pump at will. Nope, we're just getting started. And, Carbo is ready to go there with us and assist with the on-site redesign.

Enter FRACPRO XCHANGE.

Now you need to visualize that we are all rigged-up on the well and ready to pump. First we will inject into the target zone to get some initial rates and pressures. This gives us an idea of the natural permeability of the reservoir. That may be followed by an acid stage to open up the near well bore rock. Then comes the mini-frac. The mini frac breaks down (fractures) the formation for the first time and the data collected is critical to the final design.

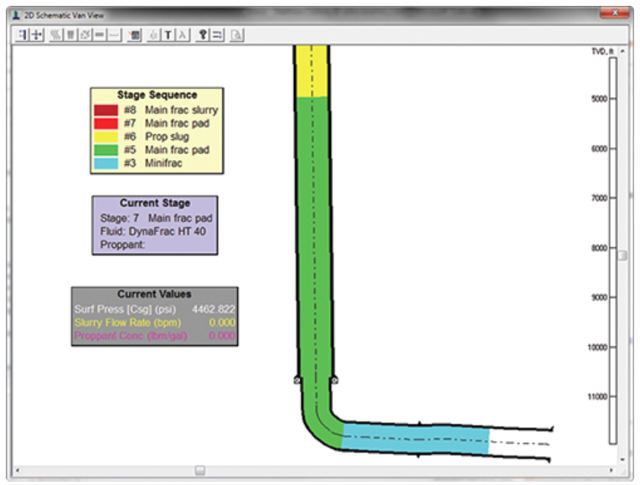

After the mini-frac a shutdown occurs to give the frac engineers a chance to huddle up with the oil company reps and do a complete frac redesign based on the mini-frac. This can take a number of hours as engineers and specialists pour over the data, discuss- perhaps on a conference call with the folks not on the rig, but definitely interested in the process. The stages that are being discussed are highlighted in the cartoon below. The core of the discussion revolves around how the proppant will be added to the slurry, how much per stage and the size of each stage. The ultimate goal is to get the maximum amount of proppant into the fissure, and create a conductive path back to the well bore.

Now we are ready to pump.

Now, it should be said, that software of this type is not unique to Carbo. The big colors (Halliburton, (HAL), Schlumberger, (SLB), and one or two of the small frackers, Liberty Oilfield Services, (LBRT) all do this and do it well. What Carbo brings is specialization, and focus. Customers like this, as sometimes they feel they don't necessarily get the best of the big colors.

Investment thesis for Carbo

So let's be clear, Carbo is a company with a tattered balance sheet. It invested in the previous boom like the music would never stop. Then the music stopped. There are green shoots though if you can look past the present, although gradually improving mess.

Insider trades- mostly open market buys.

Insiders are buying at current levels. This is usually a good sign that the people run the company think the stock will appreciate in the near term.

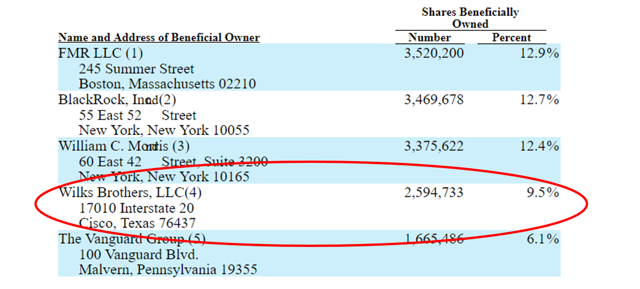

Enter the Wilks family.

In early 2017, the Wilks stepped in with loans and an injection of cash to essentially stave off bankruptcy for Carbo. The Wilks are an industry savvy family who have demonstrated a facility for making money in the oil business. As the founders of a major independent fracturing company, Frac Tech the knew a good deal when they saw it. They sold Frac Tech in 2011 to Singapore's Soverign wealth fund for $3.5 bn, pocketing about 3.2 for themselves. These guys know the frac business, and more importantly they know when to get out of it. If the Wilks brothers are seeing the potential for Carbo to do better going forward, my confidence is boosted still further.

Technology moat

Carbo has a unique product that should be coming into greater demand than they have seen in the past few years. If you need a proppant with the roundness and sphericity of Kryptosphere, they're it. There is no other.

Further they back this up with a sophisticated software modeling and rig-based support offering we have discussed above. This is a strong combination.

Goodwill

They have made inroads into the industry over the years that no other proppant purveyor can boast. They have a huge reservoir of Goodwill in the industry. This hasn't been worth much recently, but will start to mean more going forward.

New technical staff

Carbo has come to realize that Kyrptosphere won't sell itself, and have made some key hires recently. One of which is the addition this Spring of a former colleague of mine from Schlumberger, as Global Technical Champion in support of ceramics sales. This individual (he is not at the Officer level in the company, so I am not going to name him), was SLB's Global Sand Control Champion for several years. (Note- Sand Control is the market segment that SLB folds all pressure pumping into.) He is a fracking expert who can sit across the desk from an oil company engineer and help him to improve his frac design. This is how you move the needle in the oilfield.

Finances

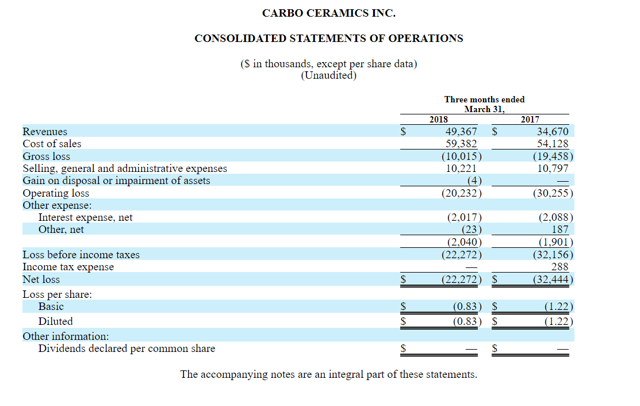

As I said in the beginning, the balance sheet is tattered, but improving with the general uptrend in the oilfield. That said, Carbo remains a deepwater story for any real share price improvement. But, it's nice to hear a note of optimism in the most recent Q-1 CC from Carbo's CEO, Gary Kolstad.

Your takeawayThe first quarter revenue was slightly above our plan. To reach a revenue of $250 million for 2018 means that the remaining quarter's need to average close to $70 million revenue per quarter. We are excited about this step up in quarterly revenue, because we are seeing a high incremental adjusted EBITDA margin on this additional revenue.

While we are very pleased with the strong adjusted EBITDA incremental margin of 42% in Q1, we expect that to increase in the following quarters. So, assuming the industry activity unfolds as we see it now and we achieve our anticipated $250 million in revenue at least, we should reach breakeven on adjusted EBITDA for the entire year of 2018. This is incredible progress when you think about it. We improve adjusted EBITDA by approximately $50 million in one year on approximately $62 million in additional revenue

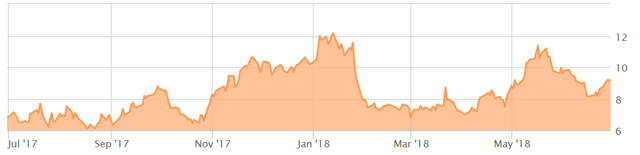

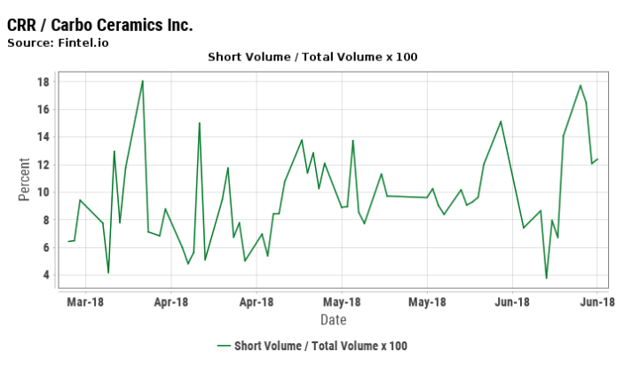

I think Carbo presents an acceptable risk reward profile at current levels. I am long, and will likely increase my position soon. As you can see the stock can be fairly volatile, and has enjoyed a recent run up in late May. In early June this reversed strongly. A chart like this usually means some big holder is shorting and a case can be made for that in the next chart down.

Somebody is pretty bearish on Carbo, in spite of improving fundamentals for the company. We disagree and think that Carbo is a speculative buy at the current levels.

There are obvious risks in this stock. Primarily being the improving oil prices driving sales of their technological offerings. If that doesn't happen, the stock could revisit early 2017 levels. This is not for the rent or mortgage payment money. Be sure that if you decide Carbo fits in your portfolio you can withstand a down draft. They do come along periodically!

Disclaimer: I am not an accountant, CPA or CFA! This article is intended to provide information to interested parties. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to complete their own due diligence before purchasing any stocks mentioned or recommended.

The Daily Drilling Report

I hope you will think about a subscription to this service. I am different than anyone else covering the oilfield on Seeking Alpha. I have spent years on drilling rigs, working with oil companies, and intend to put this knowledge to work for all of us.

Like many of you, I am a retiree. I live on social security, a pension from my employer, and savings. Savings supplies over 50% of my present income, so you can bet that I am looking for ways to maintain, and increase it. I want safe, secure dividends from my big-cap companies, along with some price appreciation. I want to score some long-ball home runs from my small caps - companies that have the potential to double or triple within a couple of years. Those are things I want, and I expect you want them too.

Disclosure: I am/we are long CRr, HAL, BHGE.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

https://ift.tt/2tSp5ll

0 Response to "Frack Class 101, Carbo Ceramics Is A Player With A Strong Technology Moat - Seeking Alpha"

Post a Comment