This report has been produced together with High Dividend Opportunities author Julian Lin.

The Business Development Companies ("BDCs") space continues to see significant improvements in its outlook:

- First of all this is a sector with a pure exposure to the United States; with the U.S. economy currently being the strongest and most promising economy on the globe, BDCs already have an inherent advantage to other stocks and sectors.

- These companies lend to small and medium size businesses which are the clear beneficiaries of the recent tax reforms. As small U.S. businesses thrive, this would result in lower default rates and increasing demand for loans that are sourced from BDCs.

- BDCs have inherent protection against rising interest rates, as most lend to their customers based on a floating rate portfolio.

- The law that recently passed allowing BDCs to increase leverage will boost the sector's profits and likely result in higher dividends.

- During periods of economic growth, BDCs tend to see solid earnings growth and increase in their share price.

Despite all of the above, most BDCs still trade at very attractive valuations. Today, we are recommending to to invest in an attractive company that provides both high yield and upside potential.

Triple Point Venture Growth (TPVG) is an externally managed business development company (‘BDC’) specializing in providing financing to venture capital backed companies at the growth stage. As we will note below, most of these companies are technology and growth companies. TPVG issues 1099 tax forms (no K-1s). This is a company fulfilling a niche role in the BDC space, and has the distinction of having invested in YouTube, Facebook, and other high profile tech companies. The stock has traded recently at a price $10.4 for a yield of 10.8%. TPVG is very cheap and has multiple levers to support further growth in net investment income and dividend growth. Shares are a strong buy for income and potential capital appreciation.

A Differentiated Focus Area

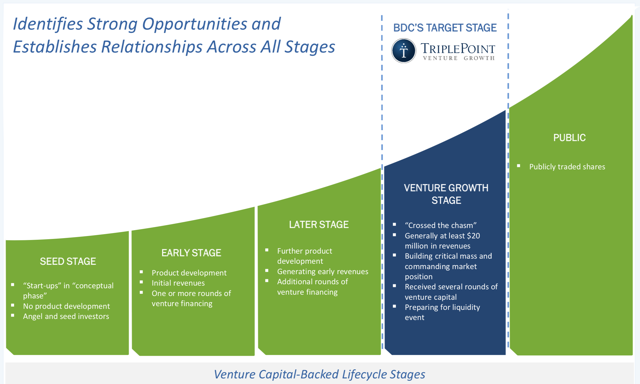

TPVG became a publicly traded entity on its IPO on March 5, 2014. TPVG is a very interesting BDC in that its customers mainly are those which are at the “venture growth stage,” which is the stage in the business development cycle right before becoming public:

Every public company at some point in time has found itself in the venture growth stage. This is a critical moment where the business idea and model are beginning to prove themselves, but the company may need extra financing to help scale operations further and faster.

Over the years TPVG has helped give financing to many well known venture growth companies, including some big names like Facebook and YouTube:

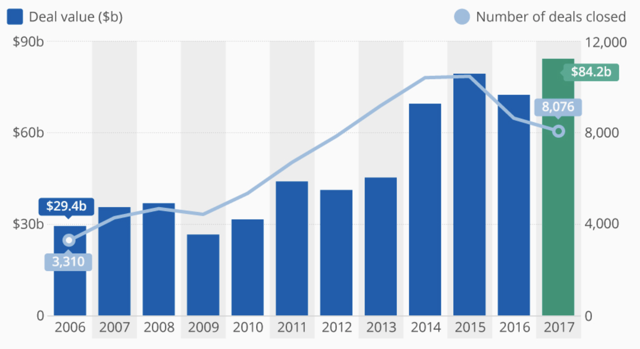

TPVG indicated on their earnings conference call that their originations pipeline for venture growth stage companies hit a new all-time high, indicating the large and rising demand for venture capital debt. In fact, according to Pitchbook, venture capital funding has seen a steady uptrend for the past ten years:

This is very important especially considering that TPVG has real potential to increase its investment portfolio through increased leverage, as we will discuss later.

Getting To Know The Portfolio

The typical investment for TPVG has the following characteristics:

- Short 3 to 4 years financing terms.

- Meaningful venture capital equity backing from existing investors.

- Loan-to-enterprise value of under 25%.

- Low overall leverage.

- Proven business models with annualized revenues of at least $20 million.

- Experienced and complete senior management team with a strong track record.

- Leadership positions or the potential to establish leadership positions in their applicable market.

- Targeted 10-18% returns.

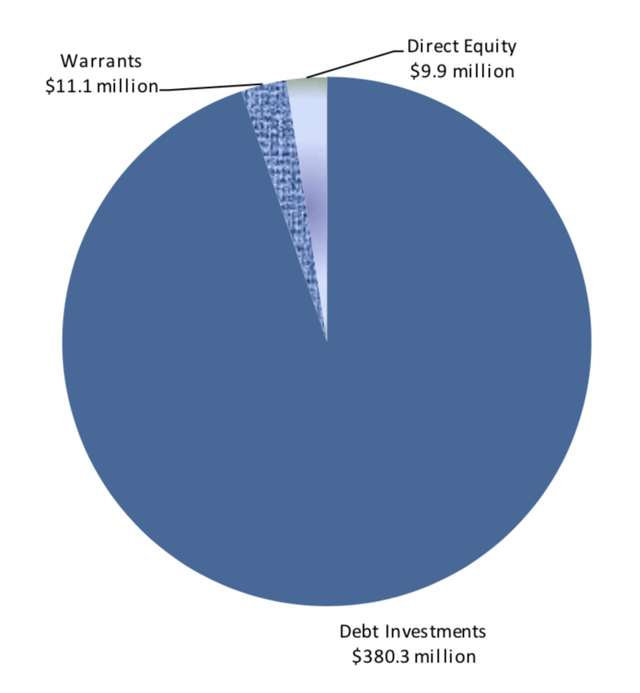

TPVG mainly owns debt investments, but also sometimes aims to increase their returns through equity and warrants:

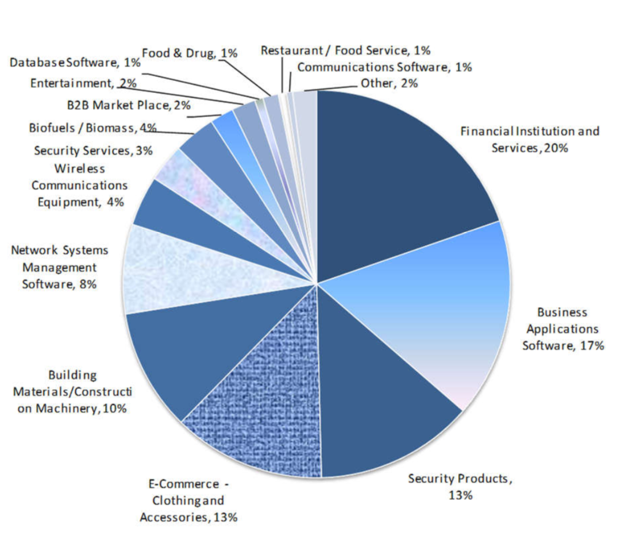

TPVG typically focuses on the technology, life sciences, or other high-growing industries. Within these high growth industries they are adequately diversified:

TPVG ranks their portfolio credit quality on a scale of clear to red, with clear being those performing above expectations and red being those showing cause for concern. Their average credit ranking was 2.03, which is in the “white” area, or the ranking they give by default to all new loans. Overall, over 97% of the portfolio was performing at yellow or better:

Some of their current debt investments are seen below:

Some readers may recognize PillPack, an online pharmacy vendor which was recently bought out by Amazon (NASDAQ:AMZN) for just under $1 billion.

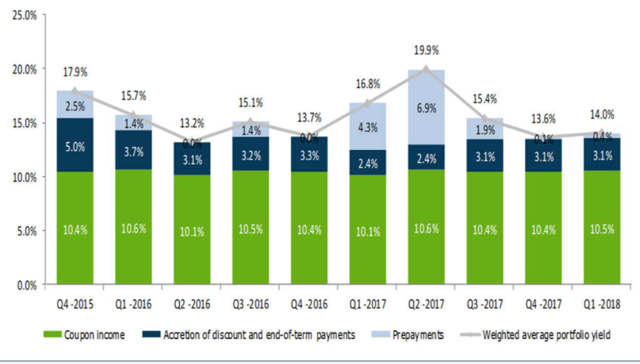

TPVG has been able to maintain a consistently high average yield on its portfolio. The most recent quarter saw the yield come in at 14%:

This high portfolio yield is important as it implies a high reinvestment yield when their debt investments mature. For example, their $50 million investment in Ring, Inc. recently was paid off due to their sale to Amazon (it appears quite a few of their portfolio companies have been pursued by Amazon). The high 14% portfolio yield means that TPVG will likely be able to reinvest this $50 million at high yields.

Fee Structure

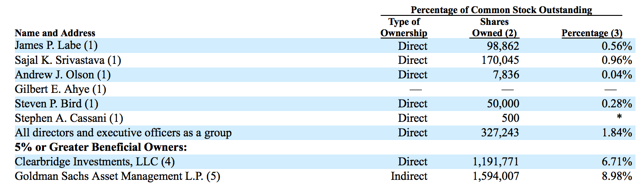

Like many BDCs, TPVG is externally managed which potentially creates conflicts of interests. To this end, TPVG has a reasonable 1.75% management fee and more importantly has 8% annualized hurdle rate for their income incentive fee, helping to align management with shareholders. Furthermore, insiders (mainly individual directors and officers) have a high ownership in their own company as we will discuss later in this report.

Recent Financial Results

In their latest quarter, TPVG earned $0.34 in net investment income per share. At first glance, this looks like it is not enough to cover their $0.36 quarterly dividend. However we must remember that net investment income is only half the picture as BDCs often have large realized gains. When factoring in realized gains, TPVG had a net increase in net assets per share of $0.45, more than adequately covering their distribution. Furthermore, as we will see just below, there are more reasons moving forward to have confidence in their dividend coverage.

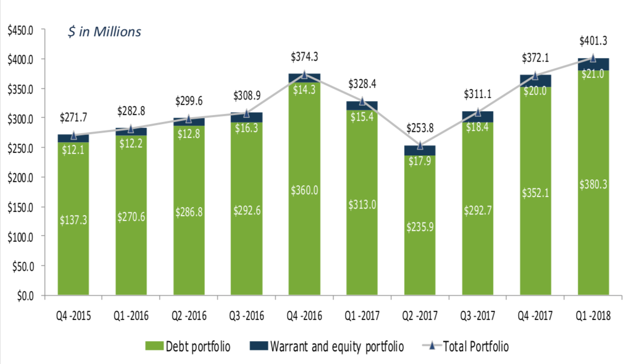

TPVG closed on $115 million in new debt commitments and funded $37.9 million in debt investments at a 13.8% average yield. TPVG also reached an all time high in their investment portfolio size at $401.3 million at the end of the first quarter:

Balance Sheet Catalyst

TPVG recently announced that on June 21, its shareholders have approved its application to reduce its asset coverage requirement from 200% to 150%. This essentially allows TPVG, should they choose to do so, to double the amount of their debt. For example, if a company had $2 in debt and $4 in total assets for asset coverage of 200%, then they would be able to take on $2 in additional debt for $6 in total assets and a new asset coverage of 150%.

This is very good news especially considering that TPVG has remained under leveraged for quite some time - recently they had a very low debt to equity ratio of 0.73 times:

As TPVG increases their use of leverage, this dramatically helps to boost shareholder returns, because the debt would be put to work in income-generating investments. Management already indicated on their conference call that they have raised their debt to equity ratio target on the high end to one times.

TPVG has a fairly low cost of capital, with a revolving credit facility that bears interest at LIBOR plus 3%. Aside from its revolving credit facility, TPVG also has issued a baby bond trading under the ticker “TPVY” at an interest rate of 5.75% due in 2022. They may be able to lower this cost of capital even further.

As stated in their annual report, TPVG has applied to receive a Small Business Investment Company (‘SBIC’) license which would allow TPVG to borrow up to $150 million in SBA-guaranteed debentures. These debentures have longer maturities and lower interest rates which would help lower their cost of capital. We have previously wrote about Fidus Investment Corporation (NASDAQ:FDUS), another BDC which has significantly utilized their SBIC licenses to attain lower costs of capital. If approved, this would be a significant catalyst as TPVG would be able to increase their overall leverage at a low cost of capital.

Dividends - Show Me The Money

TPVG has paid a consistent $0.36 quarterly distribution for the past several years:

They most recently paid their $0.36 quarterly distribution on June 15th. The dividend has been consistently covered by net investment income, but not always by net increase in net assets:

As stated above, we believe that coverage will continue to improve as they steadily make use of their lower asset coverage requirements and take on more debt (implying more investment income).

Valuation

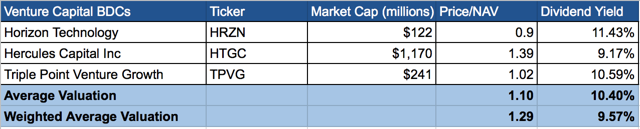

As of the latest quarter TPVG had a net asset value (‘NAV’) per share of $13.34. With the shares recently trading at $13.4 they are trading at their NAV and a dividend yield of 10.8%. Compared to venture capital peers Horizon Technology (HRZN) and Hercules Capital (HTGC), TPVG finds itself with an attractive valuation:

Price Target

We feel that the BDC universe is undervalued in general, with the average yield being 9.23% and discount to NAV being 10%. TPVG is a name which deserves to trade at even a premium to NAV especially before it further utilizes its ability to take on leverage. We feel that a 5% premium to NAV is warranted due to the strong dividend coverage and potential for growth. This represents a price of $14 per share, for a potential return (including dividends) of 15% which can reasonably be achieved over the next 12 months.

Insider purchases

TPVG has insiders which are increasing their skin in the game. There has been no insider sales since 2014 and many purchases in the past year have come at prices significantly higher than where shares currently trade:

The current ownership among insiders is significant with directors and executives owning 1.84% of the total share float as we can see in the table below:

Insider purchases help to show management’s confidence in the underlying value of their company and further align their interests with shareholders. The large and consistent amount of insider buying makes us feel more comfortable investing alongside management.

Additional Near Term Catalysts

If the discount to NAV persists or gets wider, management is likely to utilize some of their leverage capacity to buy back shares. This is something that they have done in the past, namely in 2015 and 2016 when shares also traded at high discounts to NAV:

TPVG is well placed in this rising interest rate environment, with 64.2% of their debt investments are floating rate. As stated in their conference call, management estimates that every 25 basis point increase in the prime rate would increase their investment income by $0.03 per share:

Risks

- Because TPVG invests in venture capital stage companies, this means that sometimes the portfolio companies underperform. That said, management has a long track record of successfully managing this risk. Furthermore, their ability to take on more leverage will significantly help to improve net investment income.

- BDCs are significantly reliant on a strong economy and may underperform in the event of a recession. That said, a recession appears unlikely as Fed Chairman has repeatedly indicated that recession risks are currently very low.

Bottom Line

TPVG is a well-run BDC which has a successful track record of investing in venture-growth stage companies, including investments in many well known names. Trading at NAV, shares do not appear to be pricing in their ability to significantly increase net investment income through taking on more leverage. Investors who buy today have the potential to achieve returns of 15% over the next 12 months as management utilizes their increased leverage capacities and potentially lowers their costs of capital. Investors are also locking in a very generous yield of 10.8%.

If you enjoyed this article and wish to receive updates on our latest research, click "Follow" next to my name at the top of this article.

Note: All images/tables above were extracted from the Company's website, unless otherwise stated.

About "High Dividend Opportunities"

High Dividend Opportunities is a leading and comprehensive dividend service ranked #1 on Seeking Alpha, dedicated to high-yield securities trading at bargain valuations. It includes an actively managed portfolio currently yielding 9.7% - with a selection of the best high-yield MLPs, BDCs, Property REITs, Preferred Shares, CEFs and ETFs. Subscribers benefit from "Live Alerts" to buy securities at attractive prices. We invite income seekers for a 2-week free trial to help you identify the future outperformers in the high yield space. For more info, click here.

Disclosure: I am/we are long TPVG.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

https://ift.tt/2OqiyrC

0 Response to "10.8% Yield With Exposure To Technology And Growth, Attractive Price And Upside Potential - Seeking Alpha"

Post a Comment